It is undeniable that sorting your taxes can be quite a tedious process. There are many factors to consider such as which taxes are deductible, what amount to be deducted, which income should be filed etc. etc. These are just some of many issues concerning taxes and how time-consuming it would be sort them out one by one.

With the advent of modern technology, sorting your taxes can now be easier by utilizing the so-called mobile phone apps that help with taxes.

These apps are very helpful in organizing your taxes. They are programmed to provide easy access to your taxes and other information you may need.

Below are some mobile apps that can help you with your taxes:

EITC Finder

Income taxes are a huge deduction to your total salary. Looking at the tax figures can already cause you pain especially you fall under an income category. Rendering overtime in the workplace can be an additional amount of money for you to take home, but unfortunately, still these methods are taxable. There are times when some credits have been overlooked such as the Earned Income Tax Credit or EITC that awards employees of up to $5,700 for those who earn less than $49,000 annually. One free application that allows you claim your credits is the EITC Finder. The EITC will do the calculation of the amount of money you can earn as credit. This is only true applicable when you are qualified. To utilize this mobile phone app, you need to input certain information such as the amount of your income, filing status and number of dependents.

Shoebox

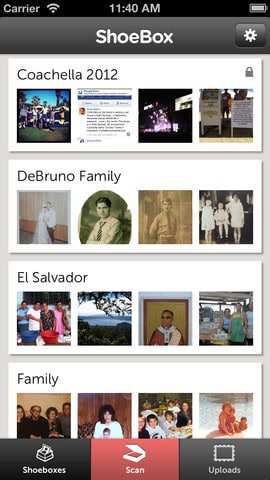

It is such a big hassle to keep track of all your receipts for the whole year. At some point, you might even lose or misplace them. Collecting or your receipts and sorting them towards the end of the year are quite a job. To help you out with this task, you can use the Shoebox application on your mobile phone. In here you can have an organization of your day-to-day receipts as you can have all the details captured and saved in your mobile phone. How to use the Shoebox feature is quick and easy. All you need to do is take a photo of your receipt. Input other details in your phone. After this is done, the information will be uploaded to your online account and will be sorted under certain categories such as fuel, meals, travel etc. From here, you can easily add up all taxes and be able to compute what needs to be deducted.

H&R Block At Home 1040EZ

The H&R Block at Home 1040EZ is an application that allows you to file your tax returns electronically. This is an effortless manner of filing your tax returns. The method is simple. By using your smartphone, take a photo of your W-2 form. Input few personal information and the data will be uploaded automatically into your online account. This app is advantageous to married income earners with a combined income of $100,000 and below or single income-earners who earn less than $80,000 annually.

Sally Everlast is a financial and electonics blogger more of her writing can be seen at irsrefund.biz